Here is an update to yesterday’s Futures Example report:

Kansas City and Chicago wheat both experienced a move just shy of 6% today.

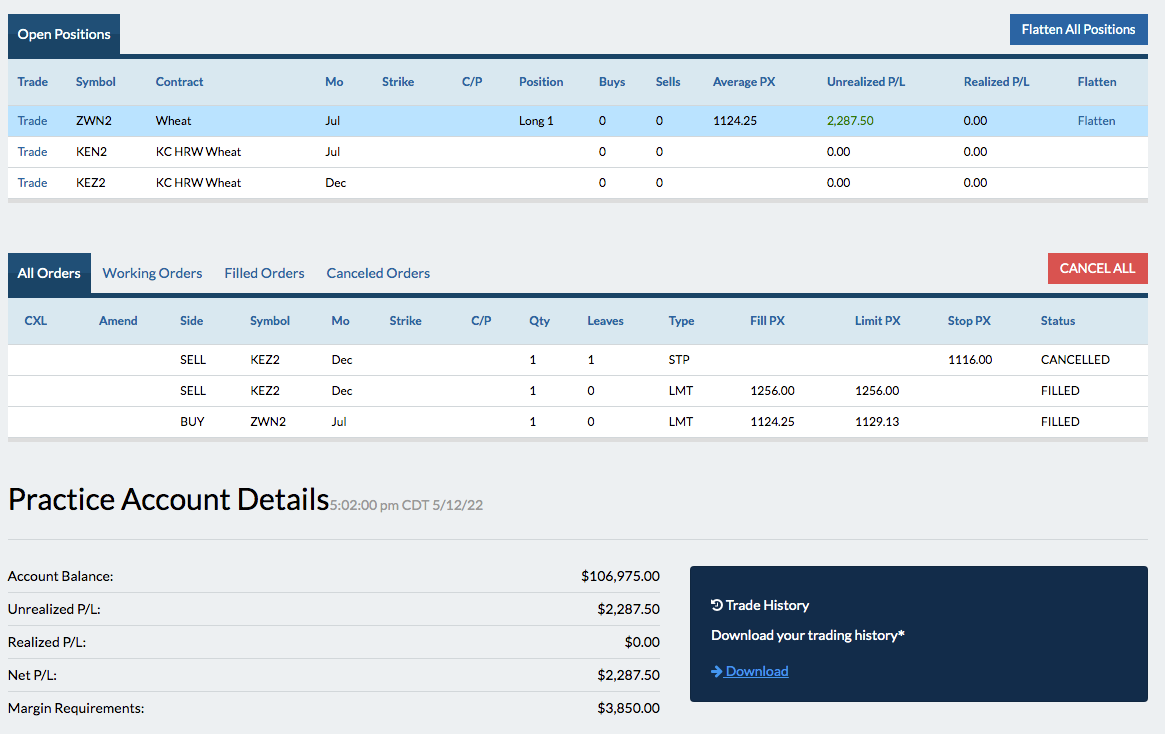

Readers will remember that I placed Take Profits orders at levels of interest where I anticipated the price to retrace or slow down.

Once the price started moving, I considered raising my stops and removing my Take Profit orders; however, I was unable to identify a level that I was comfortable with.

Today was profitable with each of the Kansas City trades closing realizing a net profit of $4687.50.

Considering that each trade is for one contract, I was unable to take partial profits and was forced to exit full positions.

In the future, I may choose more than one contract to demonstrate how to stay in the position.

Each closed contract is for 5000 bushels for a total of 10,000 bushels.

The $4687.50 profit adds 46 cents per bushel to the price of the short physical position.

The Chicago July idea was triggered and the position is still open.